Adaptive Price Zone APZ - Backtest Results and Implementation Issues

Discusses basic issues and results when attempting to back-test the APZ indicator

Data: S&P500 Emini Futures

Futures Contract Rollover: Arbitrarily set on second Friday of every Mar, Jun, Sep and Dec

Period: 28 Dec 2008 - 31 Mar 2012 (Hourly Chart)

VBA Code: Method B of

Code

Excel Version: 2010

Click

here for background information, formula, calculation steps and the entire VBA code.

There are multiple variations on how to apply an indicator. I seek your understanding that the work done below are experiments and are for information purposes only.

Summary of Results

Conventional application of the APZ (i.e. long at the lower boundary and short at the upper boundary in anticipation of price reversal) is found to be not profitable. However, the reverse is somewhat profitable (long when price exceeds upper boundary of APZ and vice versa), suggesting that this technical indicator and the applied trading rules have potential for real-life implementation with further tweaking to the application method (e.g. chart indicator based on hourly data, but trades are generated as and when the trading rules are met subsequently).

Procedure in Brief

Pasted the code into Excel with changes made as per comments in code to direct application to ranges with input data (High, Low, Close columns). Screen Shot 1 shows the output (the last seven columns). The first value of some columns are error values as their formulas include reference to cells on the first row which are actually text headings, not numbers. However, calculations in subsequent rows are unaffected.

|

| Screen Shot 1 |

Detailed Findings and Results

Inputs - Band factor is set at 2, EMA period is set at 5

Summary of Trading Rules -

1) If Close at this hour is higher than the APZ upper limit at the end of the last hour, enter long at the end of this hour

1) If Close at this hour is lower than the APZ lower limit at the end of the last hour, enter long at the end of this hour

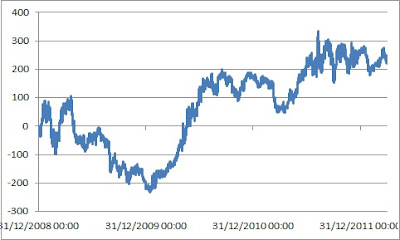

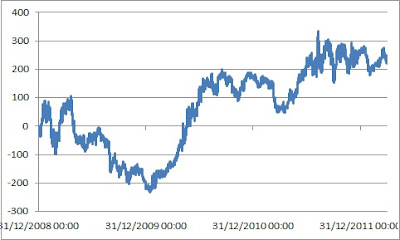

223.25 index points of profit (before transaction costs) were generated out of this strategy on 344 trades. Average return per trade is 0.65 points on a standard deviation of 21.34 points. Therefore, this strategy does not look statistically profitable. The success rate of this strategy is 39%, i.e. only 135 trades were profitable. The profit trajectory of this indicator and strategy is shown in Chart 1.

|

| Chart 1: Cumulative Profit of APZ and Applied Trading Rules |

Conclusion

Contemporary price behavior for the S&P500 suggests that the APZ is more suited for use as a "trend" type indicator, rather than a "price reversion" indicator as I have always thought. The key risk is that we cannot be certain that the behaviour of the APZ indicator versus the S&P500 will remain constant in the future. Under certain regimes, the APZ may behave as a price reversion indicator which would require the inversion of the above trading rules.

Further research can be in the application of this model in finer time granularity.

Any suggestions or comments are welcome.

Like what you have just read? Digg it or Tip'd it.

The objective of

Finance4Traders is to help traders get started by bringing them unbiased research and ideas. Since late 2005, I have been developing trading strategies on a personal basis. Not all of these models are suitable for me, but other investors or traders might find them useful. After all, people have different investment/trading goals and habits. Thus, Finance4Traders becomes a convenient platform to disseminate my work...

(Read more about Finance4Traders)